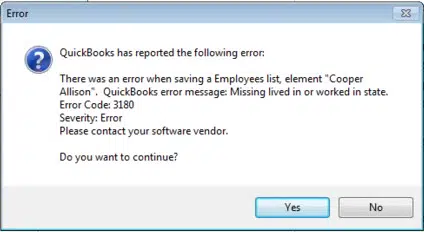

How to Fix QuickBooks Status Code 3180 Error?

The Status Code 3180 means you have used the wrong type of QuickBooks Desktop to map accounts in QuickBooks Desktop Point of Scale. You might experience this problem if you have a corrupt or damaged payment or have been classified wrongly.

The QuickBooks Status Code 3180 can increase your system’s response time, and you should fix this. We’ll go through all the possible reasons, symptoms, and methods to resolve it.

Reasons Behind QuickBooks Status Code 3180

Here are some of the most prominent reasons which lead to QuickBooks Status Code 3180:

- If the sales tax items on your QuickBooks Desktop are not linked to any vendor.

- Incorrect account mapping of sales tax payable account.

- A paid-out was created by using a sales tax payable account.

- It can also happen if the “Sales Tax Payable Account” has been used as a target account for more than one item on receipts.

Symptoms of QuickBooks Status Code 3180

You need to watch out for the following signs or symptoms to figure out the further course of action for QuickBooks error code 3180:

A sluggish response of your system to all the USB plug-ins.

- Failure to save the sales receipts.

- The suspicious shutdown of the QuickBooks app.

Methods to Troubleshoot QuickBooks Status Code 3180

Here are some of the best methods to get over the QuickBooks Status Code 3180 issue:

Method 1: Merge Items in QuickBooks

- First, open the “QuickBooks” desktop app.

- Now, click on the “Lists” option and then on “Item.”

- Under the “Item” option, choose “Include Inactive.”

- To sort the list, select the “Type Header.”

- Look for the “Point of Sale” items and rename them.

- Right-click on “Point of Sale” items and tap on “Edit.”

- While renaming, add “OLD” in front of the item name and press “OK.”

- Run the financial exchange from the “Point of Sale.”

- Finally, merge all the duplicate items in “QuickBooks Desktop.”

- Before exiting the window, search for all the files with the “OLD”

- Right-click on these files and remove “OLD,” and then tap on “OK” followed by “Yes.”

Method 2: Make sure you assign the vendor to the sales tax item

- Go to the “QuickBooks Desktop” app.

- Under the “Lists” option, click on “Items.”

- Now, choose “Include Inactive” and wait for the list.

- To sort the list for better visibility and understanding, choose the “Type Column.”

- Verify the complete list and check whether each sales tax item has a tax agency attached to them.

Method 3: Choose your Tax Preference

- Open the “QuickBooks Point of Sale” application.

- Head to the “Files” menu and choose “Preferences.”

- In the “Preferences,” you need to choose “Company” and click on “Accounts under Financial.”

- Alongside the previous step, tick on the “Basic” and “Advanced” tabs.

- Also, opt for “male Sales Tax payable” in the “Sales Tax” row.

Method 4: Ensure that you have not paid out the problem receipt using Sales Tax payable

- Start the “QuickBooks Point of Scale” application on your system.

- In the app, go to the “Sales History.”

- Right-click on any column and opt for the “Customize Columns” option.

- Now, select the “QuickBooks Status” and later search for the incomplete “Receipts.”

- Look for the “Receipts” if any receipts are paid to the “sales tax payable.”

- Later, click on the “Reverse Receipt.”

- By using a non-sales tax payable account, recreate the paid-out transaction.

- Finally, run a financial exchange.

Method 5: Rename the Financial Methods

- To begin with, open the “QuickBooks Desktop.”

- Go to the “Lists” menu & under it, choose “Customer & Vendor Profile Lists.”

- Now, choose the “Payment Method” list.

- Tap on the “Cash Method” right-click on it and opt for the “edit Payment Method” option.

- After clicking on “Edit Payment Method,” in the payment method field, you can see “X” in the beginning. Save all the changes.

- Again, right-click on the “cash method” option and select “New.”

- Rename it “cash” and then initiate a “Financial Exchange.”

- You can also change the name of all other payment options if required.

Conclusion

We hope we have discussed everything at this point, from the causes to all solutions to troubleshoot and avoid QuickBooks error 3180 in the future while accessing the “QuickBooks Desktop”. Remember, you will come across error 3180 whenever there is any faulty or damaged payment in the QuickBooks Desktop Point of Scale application.

Therefore, resolving the error as soon as possible is essential, or it can harm your system by decreasing its overall efficiency, or you’ll have to bear a data loss. All these methods are reviewed and recommended by our team of experts, who have a great reservoir of knowledge about QuickBooks and the errors you all face while using it.

For any further assistance, you can contact us or directly connect with the 24/7 QuickBooks error support team via our helpline i.e, 1-800-615-2347, or chat with our experts.